How to make an offer on a home in Pacific Beach

After finding the perfect home, you want to make an offer that the seller will accept, while at the same time, feel like you’re getting a deal.

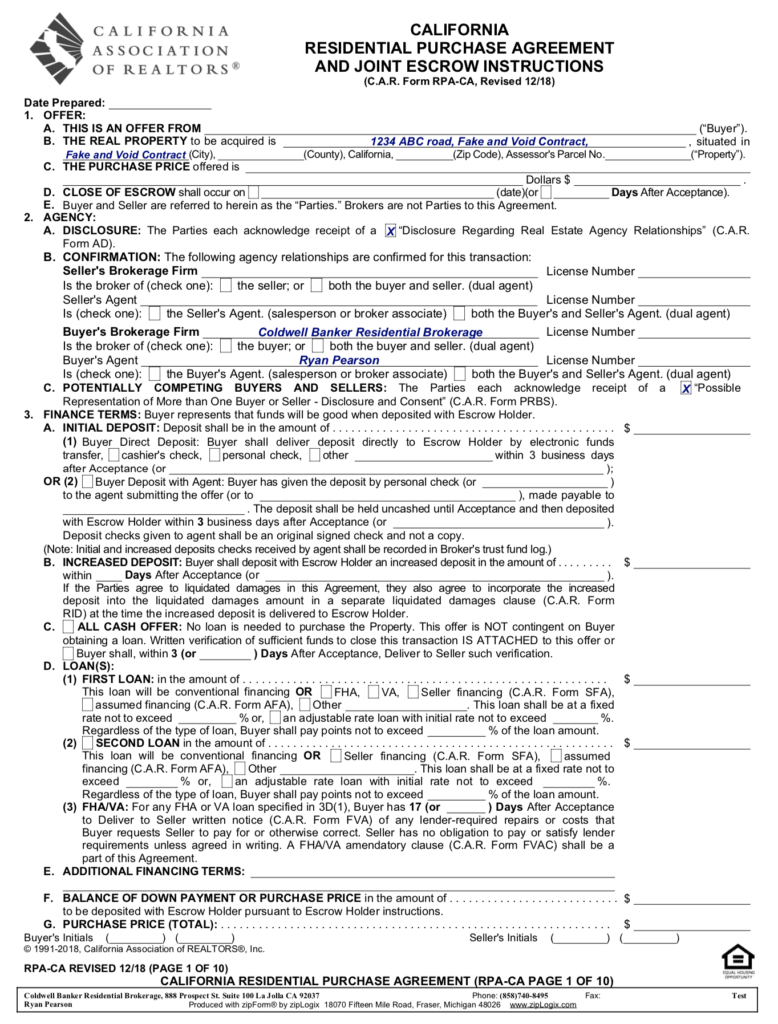

Realtors in California will use a Residential Purchase Agreement to send to the seller. Before pen goes to paper, all buyers should understand the elements of making an offer on a home.

Ask us to see a full copy of a Residential Purchase Agreement (RPA)

What goes into an offer?

Price

You need to talk with your real estate agent to see what other similar homes have sold recently.

This can be tricky depending on how unique the desired home is, but usually means finding other homes with similar:

- number of bedrooms

- bathrooms

- square footage

- lot size (if it’s a house)

- similar quality or condition

- location (same street or nearby)

- market time (sold within the last 6 months)

After reviewing 2-5 of these comparable properties (“comps” for short) and analyzing how they differ from the home you want, you can calculate the value of the property.

After you calculate the value of the property, you can determine how to approach your offer price. Depending on the activity generated by the property, how long it’s been on the market, and any other issues with the home, you can determine what price you are comfortable with offering.

Earnest Money Deposit

The earnest money deposit (EMD) is cash a buyer uses to show they are interested and motivated to complete the sale.

The cash will be sent to escrow within 3 days of acceptance of an offer and eventually will be put towards the down payment or closing costs.

Typically the amount of cash used for this deposit is between 1 and 3 % of the purchase price.

The residential purchase contract is usually written with 3% of the purchase price being the maximum amount of liquidated damages the Seller can sue for. Thus creating the traditional maximum earnest deposit amount of 3%. (If the Seller can’t get more than 3% of the purchase price in damages, why should the buyer put more than that amount into escrow?)

Length of escrow

Escrow is typically a 30-45 day process but the number of days is negotiable. Think about your life schedule as well as what will work best for the Seller. If the Seller has a replacement home, they probably want a shorter escrow period. If the seller still needs to find a replacement home, you may offer a longer escrow period, or a “rent-back”. You will want to offer a time period that works for both parties. Keep in mind any lease agreements you have in place, school schedules, and potential issues with moving around specific dates.

Length of contingencies

Contingencies are some of the most confusing but important parts of making an offer on a home.

The definition of a contingency is:

“a future event or circumstance which is possible but cannot be predicted with certainty.”

Why contingencies are important

To help us understand what a contingency is and why it matters, we have to ask ourselves a question.

“What does each party have to lose once an offer is accepted?”

The Seller will take the property off of the active market. This could mean that another potential buyer wont see it. Contractually, it’s hard for a Seller to cancel escrow and get the home back on the open market.

A buyer will be required to submit an “Earnest Money Deposit” to escrow upon an accepted offer. The buyer will also spend time and money conducting inspections. The buyer may discover something that makes them change their mind on purchasing the home.

We already learned that the Earnest Money Deposit (EMD) is used to show that the buyer is interested in the property. The buyer is moving funds, showing that they are capable and working in good faith to purchase the property. This E.M.D. is potentially at risk of being forfeited to the Seller if the buyer cancels escrow, to compensate the Seller for any damages.

However, as long as the buyer has contingencies in place, the buyer can usually cancel escrow and receive all of their Earnest Money Deposit back.

How contingencies affect buyers and sellers

The buyer needs to show the Seller that they are the real deal, to make the Seller comfortable with the fact they are taking their property off of the market. So the buyer sends money to escrow.

While the Buyer does inspections, reads disclosures, and secures a loan, they can discover things that may make the Buyer change their mind on buying the home. If the buyer discovers an issue within reasonable time, they should be able to cancel escrow and get all of their Earnest Money Deposit back.

However, if the Buyer takes excessive time in their research of the property and keeps the Seller in limbo, with their property off of the market, it’s unfair to the Seller.

Contingencies represent important factors for the buyer to purchase the property.

For real estate you can imagine a contingency as a lock, protecting a buyer’s safe. Inside of the safe is the buyer’s earnest money deposit – cash.

At the end of escrow, the buyer’s earnest money deposit will go towards their funds to purchase the property. However, during escrow, while the buyer is doing research, the EMD sits in escrow while the buyer unlocks all of the locks/contingencies protecting the EMD inside of the “safe.”

The buyer can choose to cancel escrow due to an issue with the property, appraisal or loan, and as long as there is a contingency in place, that lock/contingency is protecting the buyer’s earnest money deposit.

If the buyer’s earnest money deposit is protected by a contingency, the buyer should be able to get their money back without the Seller suing for damages. There are a lot of different things that can happen throughout an escrow, so you should consult your realtor if you have any questions about this. The above is written to give you a better idea at how contingencies work, and not to be taken as legal advice.

The purchase agreement is usually contingent upon 3 things:

Inspection contingency:

You will want to hire an inspector and also review Seller disclosures to confirm the condition of the property. Once you are satisfied with the condition of the property, and any request for repairs are completed, you can remove your inspection contingency. The typical period for an inspection contingency is 17 days, but depends on escrow length and situation.

Appraisal contingency:

If the buyer is using a loan to purchase the property, they will usually need an appraisal. Your lender will hire an appraiser who will need to agree with the purchase price and loan amount of the property. Once an appraisal comes back and confirms the market value of the property, you can remove your appraisal contingency. The typical period for an appraisal contingency is 17 days.

Loan contingency:

The lender has a lot of files to review, including information about the buyer, property and investor guidelines. Getting full loan approval typically will be the longest part of purchasing a property, but once you have full loan approval, you can remove the loan contingency. The loan contingency is typically 21 days.

Sometimes the purchase agreement can also be contingent upon the sale of the Buyer’s property. If the buyer needs funds from the sale of their current home in order to purchase the new home, this contingency may be put into place. In the competitive market of Pacific Beach, adding this contingency will make the offer much weaker in the eyes of the Seller.

However, if the Buyer’s current home is already in escrow upon the time the offer is made on the property, it can mean that the Buyer will be extremely motivated to close on the new home.

If the buyer doesn’t secure the new property, they could be homeless for a period if their old home sells and they don’t buy the new property.

Who pays for services like escrow, title, disclosures?

These are all negotiated in the offer.

Typically escrow fees are split between the buyer and seller, and each side will pay for their own fees.

There are two types of title fees. Homeowners title insurance and lender’s title insurance.

The Seller typically pays for owner’s title insurance and the buyer will pay for lender’s title insurance.

Home Warranty

A home warranty can be purchased for the home and protects appliances within the home, including the refrigerator, dishwasher, oven and stove. The warranty can also be upgraded to include washers, dryers, air conditioning systems, pools and jacuzzis, among other items.

The home warranty will help repair appliances or potentially cover the cost of a replacement, if the equipment becomes faulty. The warranty allows the new owner of the home to only have to pay a deductible for this service. The deductible is usually around $60.

It is common for Buyers to request a Seller to pay for a 1 year home warranty, but it is negotiable.

Termite

It used to be common for the Buyer to request “section 1 termite clearance” from the Seller of the property. However, around 2015, lawyers involved with California real estate determined that termite requests should be negotiated as part of a request for repair, and not at the time of the purchase agreement.

Since knowledge of termite damage was repeatedly discovered after a purchase contract was agreed upon, they found that it was not appropriate for the Seller to agree to section 1 clearance before they knew what actual damage was apparent.

Equipment included in sale

Does the property have a fridge? Shed in the back? All fixtures (like a furnace or built in shelves) are expected to be included in the sale, but any movable equipment, including chandeliers should be included in the contract verbiage.

How to make a counter offer

Ask us to see a copy of what a Counter-offer looks like

Counter offers are common and will only counter terms that are different than what is in the purchase agreement. Discussing the elements of a counter is extremely specific to the transaction and should be something you discuss with your real estate agent.

View homes for sale in Pacific Beach